Program Overview

Our Mission

The Commons Foundation mission is to support sustaining the town of Little Compton by increasing access to home ownership for qualified families and seniors in the Little Compton community. Our programs provide resources that help increase home ownership for families and seniors and help the community retain and grow our school populations and employment in fields traditionally associated with Little Compton.

Who Is The Program For?

The loan program is for qualified individuals and families who have a connection (family, school, or work) to Little Compton and need access to financial resources to make homeownership in Little Compton a reality.

The loan program is designed to support families who plan to reside in Little Compton and whose income and other characteristics are generally recognized as middle income.

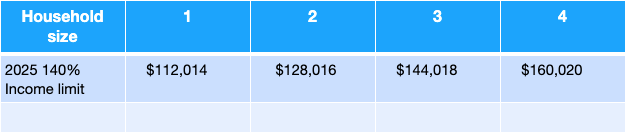

- Household income up to 140% of Family-size HUD defined AMI (AMI) for Providence Fall River area, with no lower limit. Area Median Income (AMI) is the middle income for families in a specific area, calculated each year by the Department of Housing and Urban Development (HUD). The Commons Foundation may consider up to 180% AMI, depending on other qualifications.

- For reference, in 2025 these limits are:

What Projects Qualify?

Projects that help support the TCF mission to support access to affordable and attainable housing. This is a wide-range of possibilities that could include:

- Building a new home in Little Compton on land you currently own

- Buying a home in Little Compton, with TCF providing some of the down payment

- Completing or refurbishing a home in Little Compton

In general, homes qualifying for the loan program are in the range of “average sized homes” for Little Compton. For reference, homes sized under 1800 sq. Ft. are considered average sized, for the primary dwelling. Separate units, e.g., ADUs, sheds, or barns are not included in the sq ft range. The Commons Foundation may consider other projects.

If you are not sure if you or your housing project qualifies, please contact us.

The Loan Process

- Pre-Application: Determines if you meet initial qualifications for the loan program.

- Application: Once we review the Pre-Applications, we will reach out to those who meet the initial qualifications and request additional information to prepare a complete application. If you need help, we are available to walk with you through the rest of the process so you will fully understand what you need to complete your application. *At this stage, you can expect more detailed information requirements – construction documents, credit check, proof of income, etc.

- Approval: The loan request is assessed and approved by TCF. We will work with you on the final loan agreement.

- Loan issued!

The Loan Agreement - Ensuring Mission Alignment

The purpose of the loan must align with our mission to support families and seniors wishing to reside in Little Compton. As such, the loan agreement will include terms that help ensure the resulting project will remain in the middle income affordable category for a ten year period. While each loan may have unique circumstances, some examples of terms you can expect:

- Will serve as a Primary Residence for minimum of 10 years

- Cap on resale price in the first 121 months to enable resale to middle income families and seniors wishing to remain in Little Compton

- Sale Price not to exceed the initial purchase price/post-construction project value plus approved capital expenditures, adjusted by changes in CPI from the date of ownership to the date of sale.

- No payment required during the ten year period

Important Program Details

- Generally, $50,000 Minimum to $100,000 Maximum loan amount. Other amounts will be considered on a case-by-case basis.

- Loan Term of up to 10-years (120 Months)

- Interest rate of zero (0%)

- Repayment is due at end of the term*

- Prepayment allowed

- The loan is secured by a promissory note or mortgage on the subject property as a subordinate lien-holder

* Loans may be renewed at the end of the term, but qualifications will still need to be met.